Sharesight Review: An Accountant’s Take on CGT, DRPs & Tax Reporting

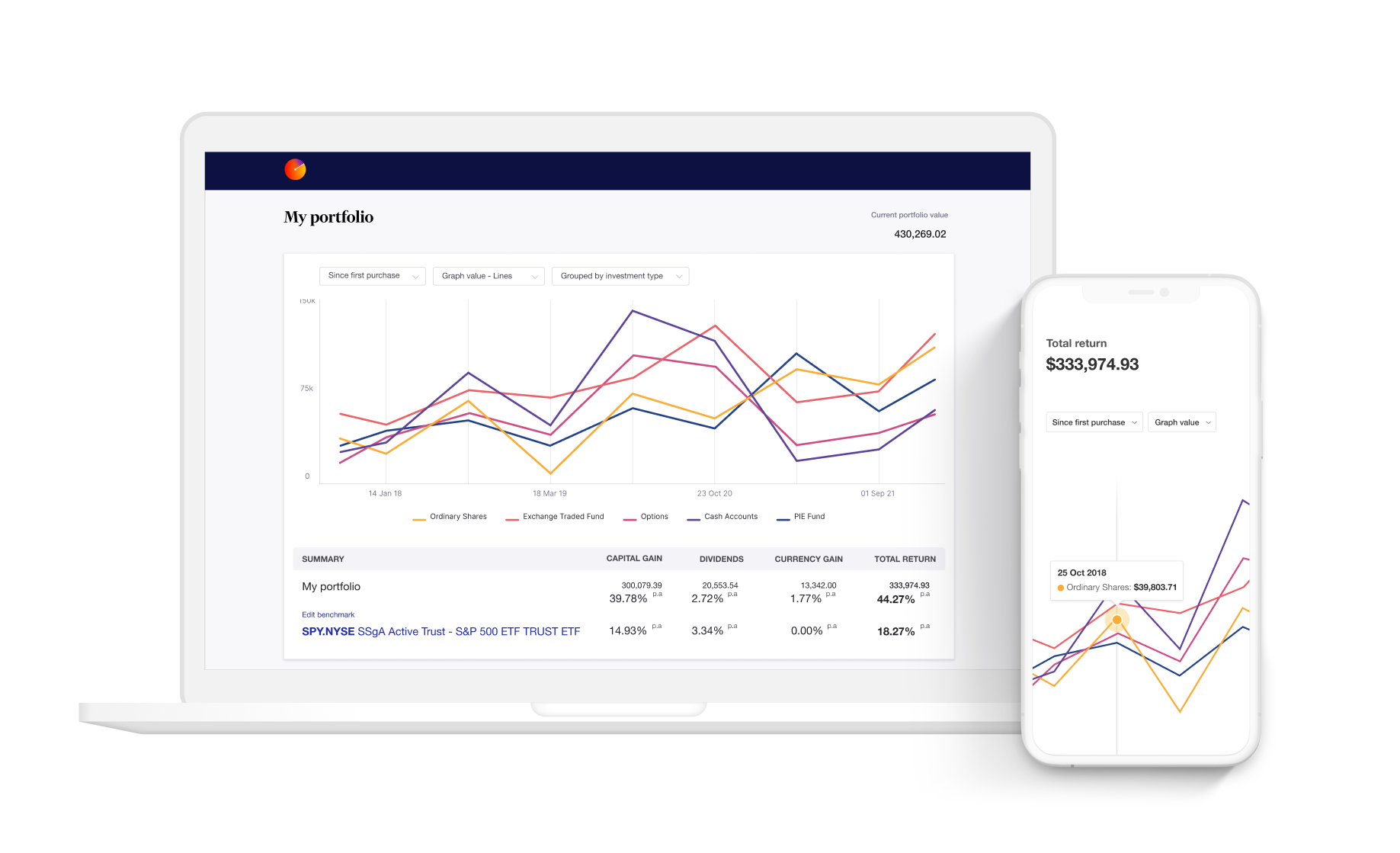

Sharesight is one of the most popular portfolio tracking tools for Australian investors—and for good reason. It automatically tracks dividends, capital gains, and performance across multiple brokers, making tax time easier and investment decisions clearer.

But is it right for you? And what do investors get wrong?

As an Accountant working with sole traders, investors, and content creators, I’ve helped hundreds of users set up Sharesight correctly—and fix costly mistakes. Here’s my honest take.

✅ What Sharesight Does Well?

Sharesight shines in a few key areas:

- Automatic dividend, purchases and sales tracking for most listed global equities across almost all exchanges in the world

- Capital gains tax (CGT) reporting with support for discount methods and parcel selection

- Performance reporting that includes income, currency effects, and fees

- Multi-broker support so you can consolidate trades from CommSec, SelfWealth, Pearler, and many more

- Integration with Xero for investors who run a business or SMSF

- Multiple portfolio setup for managing different type of investors with different tax characteristics (individuals, companies and Self managed Superfunds) under one master account

- Ability to share your account with third parties like your accountant at tax time. Requires an accountant familiar with Sharesight

For passive investors and dividend-focused portfolios, Sharesight can save hours of manual tracking.

❌ Where Sharesight Falls Short

While powerful, Sharesight isn’t perfect—especially for users with complex portfolios or tax needs.

📥 Manual Imports Can Be Tricky

Importing historical trades or large CSV files requires careful formatting. There’s no bulk undo, and errors can distort performance and CGT reports.

💰 Free Plan Limitations

The free plan supports only 10 holdings and excludes CGT reports. Many advanced features have been removed from the free tier, nudging users toward paid plans once they’re invested in the ecosystem.

🪙 Crypto Tracking Still Needs Work

Sharesight supports over 100 cryptocurrencies, but corporate actions, staking rewards, and ATO-specific tax events often require manual input. You may need a dedicated crypto tax tool or accountant familiar with crypto reporting.

🏠 Direct Property Feels Like a Workaround

Property must be added as a custom investment, with income and expenses entered as net distributions—similar to REITs. There’s no support for depreciation schedules or loan offsets.

💸 Borrowing to Invest Requires Creative Setup

Loans must be entered as negative cash balances. This reflects net portfolio value but doesn’t track interest expenses or gearing ratios natively.

🔁 DRPs Require Manual Updates

If you participate in a dividend reinvestment plan (DRP), you must manually edit each distribution. Otherwise, new units won’t be added to the cost base, leading to incorrect CGT and performance metrics. If you have lots of investments and opt in and out of DRPs this can require a lot of manual input. If you don't manage it well, this can lead to incorrect capital gains tax reporting when you sell.

🧾 Corporate Actions Demand Expertise

Events like demergers and spin-offs require manual adjustments. You’ll need to read both the investment’s guidance note and Sharesight’s help article to get it right. Most investors don’t have the expertise to do this without an accountant.

🧠 Accountant’s Take: How to Use Sharesight Responsibly

Sharesight is a reporting tool—not a source of truth. Here’s how to use it wisely:

✅ Reconcile with Broker Records

Always cross-check trades, income, and corporate actions with your broker’s statements. Use Sharesight for performance tracking and tax estimates—not final lodgements.

🧾 Review CGT Reports Carefully

CGT calculations depend on accurate cost bases and corporate actions. Export the CGT report and compare it to your broker’s annual tax summary before lodging.

💸 Document Loans Separately

Entering a loan as a negative cash account works, but it’s a workaround. Keep a separate record of interest expenses and loan details for tax purposes.

🔄 Update DRPs and Corporate Actions Promptly

Don’t wait until tax time—update DRPs and corporate actions as they happen. If unsure, consult an accountant familiar with Sharesight or watch one of my walkthroughs.

📚 Leverage Tutorials and Community Support

Sharesight’s help center is useful, but my tutorials break down complex updates in plain language. I also share Excel workflows for reconciling trades, tracking DRPs, and validating CGT.

🎯 Ready to Get Started with Sharesight

Whether you're tracking dividends, managing DRPs, or preparing for tax time, Sharesight can simplify your portfolio—if it's set up correctly.

✅ I’ll help you get it right from day one.

- 🔗 Start your free Sharesight account — includes up to 10 holdings

- 📺 Watch my Sharesight setup tutorials — step-by-step guidance for Australian investors

- 🧾 Learn how to avoid common CGT mistakes, track DRPs, and reconcile your portfolio with confidence

I use Sharesight myself and help others get the most out of it—without the tax-time stress.

⚖️ Affiliate Disclosure

Some links in this post are affiliate links, which means I may earn a commission if you sign up. I only recommend tools I use personally and believe will genuinely help my audience.