How to Report Capital Gains Tax (CGT) Correctly with Sharesight

Struggling with CGT reporting for your shares or ETFs? In this guide, I show you how to rebuild five years of records, adjust for DRPs, and calculate your net capital gain using Sharesight—all in under 10 minutes. Includes a free checklist and MyGov walkthrough.

Continue reading

How to Track RSUs in Sharesight: A Step-by-Step Guide for Investors

Learn how to track your RSUs and employee stock plans in Sharesight—from grant to vesting, dividend income, and tax reporting. Includes portfolio setup and bonus tips.

Continue reading

How to Import Opening Trades into Sharesight Using CSV (CommSec, Selfwealth, Superhero)

Learn how to securely import your opening investment balances into Sharesight using CSV files from brokers like CommSec, Selfwealth, and Superhero—no passwords required.

Continue reading

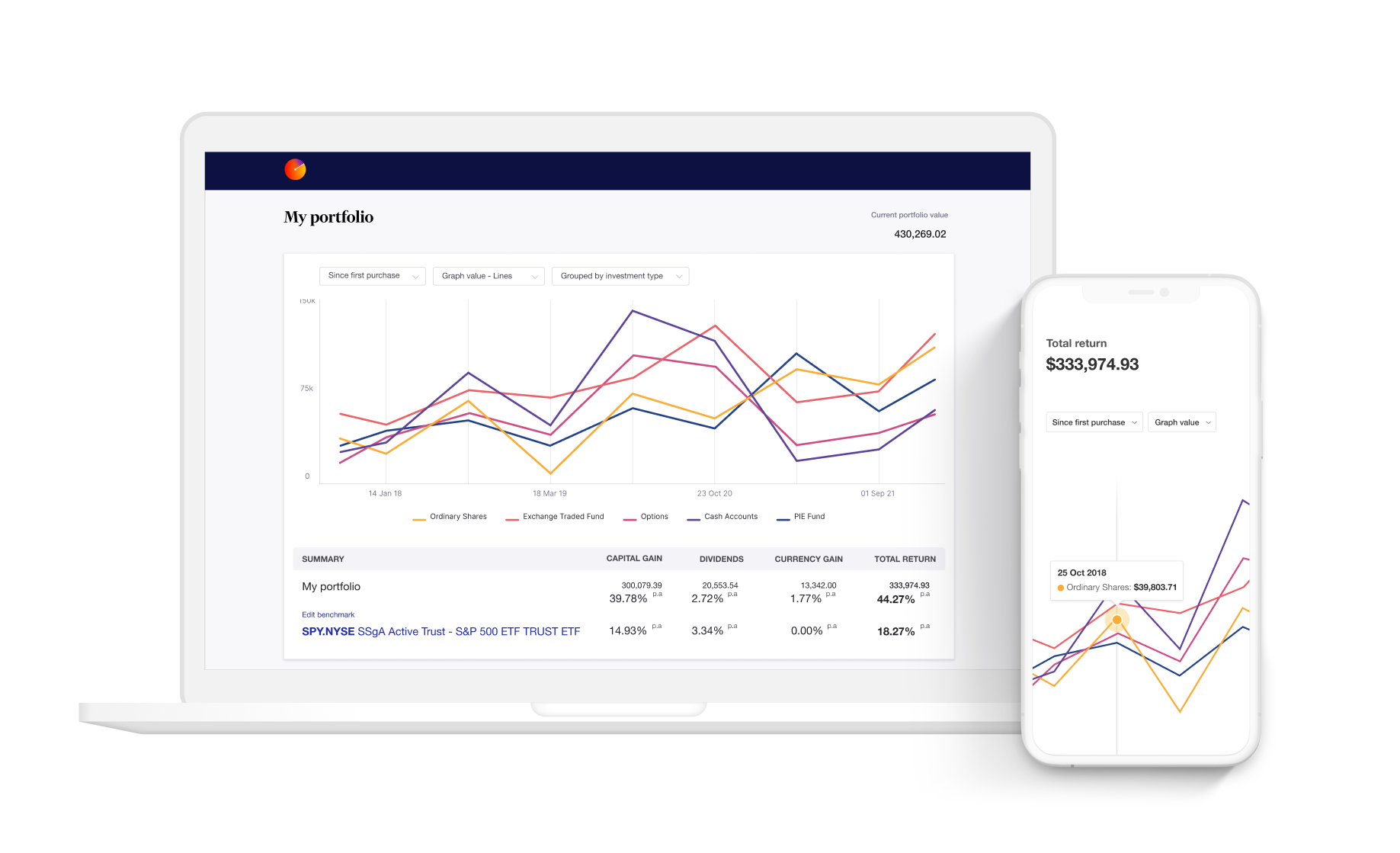

Sharesight Review: An Accountant’s Take on CGT, DRPs & Tax Reporting

Sharesight promises to simplify tax reporting for investors—but does it deliver? As an accountant, I break down the pros, cons, and common mistakes to watch out for, plus how to set it up correctly for CGT and dividend tracking.

Continue reading

Claiming Vehicle Expenses in Australia: How One Uber Driver Unlocked $5,675 in Tax Savings

In this guide, I break down how one Uber driver boosted his vehicle deduction by $16,940 using the ATO logbook method, and how any Australian sole trader—whether you’re a content creator, freelancer, or mobile service provider—can apply the same strategy. You’ll learn the difference between the cents-per-kilometre shortcut and the logbook method, get step-by-step instructions to lodge your claim in myTax, and grab a free downloadable logbook to start tracking today.

Continue reading